Insurance in the Netherlands - premiums volksverzekeringen

author: Maciej Wawrzyniak29 August 2023

Premiums volksverzekeringen are all premiums paid for social insurance in the Netherlands, taken from your monthly salary. They are mandatory for permanent residents of the Netherlands and non-residents subject to income tax. So they apply to Poles going to work abroad, so it's worth taking a better look at how they work - welcome.

Do you have to pay insurance in the Netherlands?

Social insurance in the Netherlands is paid along with the advance tax payment. The employer deducts from your salary an advance payment for income tax(inkomstenbelasting), as well as for insurance(premium volksverzekeringen).

According to current legislation, mandatory insurance covers all persons legally residing or working in the Netherlands and paying income tax on their salary.

Included in the insurance amount are:

- Algemene Ouderdomswet (AOW),

- Algemene nabestaandenwet (Anw),

- Wet langdurige zorg (Wlz).

All of these premiums add up to the total amount that makes up most of the tax withheld from your salary. Volksverzekeringen premiums in the Netherlands average 28% of your salary. Such a high rate will ultimately affect your tax refund from the Netherlands. A lot right?

How much are insurance rates in the Netherlands?

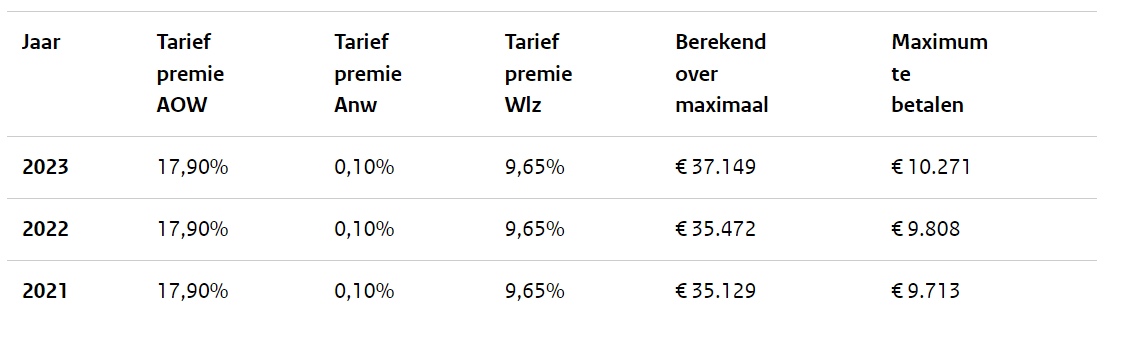

In 2023, social security contributions will be: 17.90% AOW, 0.10% Anw and 9.65% Wlz. The amount payable is calculated solely on the basis of an income not exceeding €37,149. Social security contributions to be paid in 2023 can reach a maximum of €10,271.

See the table showing the deduction rates for 2023,2022 and 2021

The following table shows the social security contribution rates applicable for the years 2021 to 2023 inclusive. From it you can find out the maximum amounts charged on this account from your salary. However, the final amount will depend on the taxpayer's income. This table applies to people who have not reached retirement age in a given year.

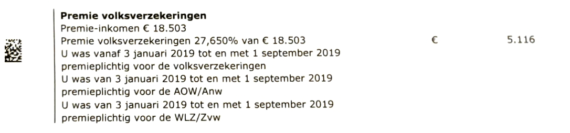

The amount of the deduction also depends on your period of work in the Netherlands. If you have worked temporarily, such as only half a year, then your Heffingskorting tax credit is recalculated according to the number of days of insurance, and in turn the tax base varies according to the period worked. If you have a tax decision from the government, note that the second page shows the period of being subject to social security. This is very important and crucial to the correctness of the calculation.

How to check if I am insured in the Netherlands?

In "My SVB" you will find all the information you need about your insurance. Look for the data under "Current status" (Statusoverzicht). You can log into your account using your DigiD ID. If you do not have it, replace it with another electronic identification document recognized at the European level.

Unpaid insurance in the Netherlands can be found in the "List of debts" (Schuldenoverzicht), along with the amount to be paid.

Living outside the Netherlands and social insurance

You do not always have to live in the Netherlands for there to be an obligation to pay contributions. You are subject to Dutch insurance if:

- you have employment in this country and pay taxes and contributions (you do not have a posting certificate issued outside the Netherlands),

- you are self-employed in the Netherlands and have legally taxed income,

- you are working at a Dutch embassy or consulate or other Dutch state institution located outside the Netherlands,

- you are outside the Netherlands as part of your studies and have no income.

Insurance in the Netherlands - expatriates do not have to pay premiums

If you are a posted employee in the Netherlands and work under the insurance rules in Poland, you are usually exempt from paying insurance in the Netherlands. You can easily tell this fact, for example, by the amount of advance tax, where a posted person has a much lower tax deducted from his salary, because he does not have to include volksverzekeringen premiums.

In order to receive a formal exemption, you must file a tax return and specify in it that you are requesting an exemption from premiums for the income received. For confirmation, you should have an A1 form issued by a Polish office as proof of being subject to insurance in a country other than the Netherlands. You do not need to send the A1 form to the authorities together with your paycheck, as the authorities have information from your employer regarding the exemption. However, sometimes the office will ask for additional documentation, most often if your employer has not filed a declaration with the office.

After submitting your tax return you will receive an Aanslag decision, on which the amount of insurance deduction will be 0. This means that the office has formally accepted the insurance exemption in your Dutch tax return.

Are you facing paperwork with the tax office? Do you need to file an annual return, or are you applying for various types of benefits? Then use our calculator Dutch tax refund calculator – simply input the necessary information into our tool, and it will automatically incorporate them. This applies equally to all matters relating to the Belastingdienst. With our app, you can quickly calculate the expected amount of grant or tax refund you are eligible for.