Would you like a tax refund from the Netherlands, but don't know how to do that? A visit to the Tax Office is not convenient to you? Check the first English application designed for completing settlements in the Netherlands. Thanks to Belastingaangifte.pl you will receive as much as 100% of tax refunded from the Netherlands and you will have the possibility of applying for Zorgtoeslag. Online assistance with tax settlements with the possibility of obtaining support of a tax advisor in the Netherlands. We are looking forward to cooperating with you! M form, C from? No problem with aangifte24.com

Dutch Tax Refund.

The first English app to submit returns in Belastingdienst.

M form, C form, P form.

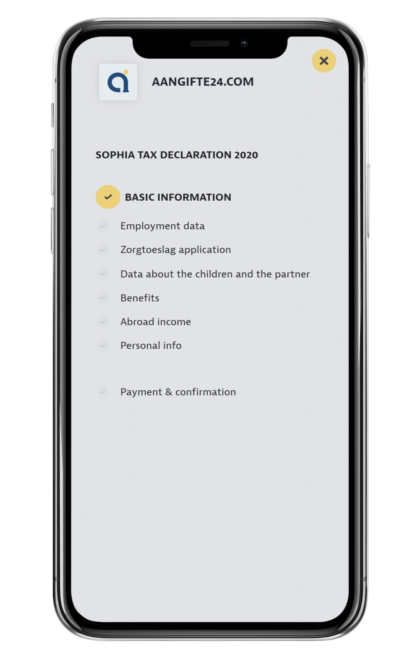

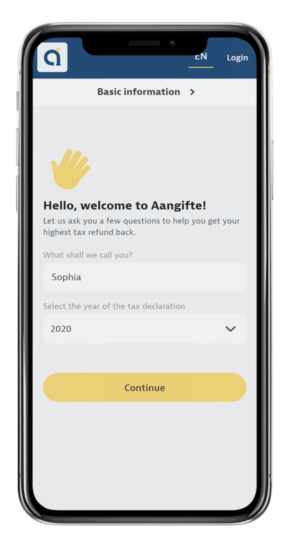

Dutch tax settlement using the app - how does it work?

After entering the basic data into the NL calculator, the amount of the tax refund or amount to be paid is displayed. The Dutch tax refund calculator is the only English tool that accurately estimates the result for the tax year. The software automatically verifies the entered data and suggests the most advantageous settlement: with the 90% condition, with insurance abroad or the Netherlands, with a fiscal partner. The Dutch tax refund calculator provides complete convenience and safety of the service.

Simple, fast

in English.

- safe and quick tax refund

- 5-year service warranty

- we have a BECON number and we operate legally

- 11 years of experience

- we analyse your returns covering up to the last 3 years

- you connect to a dedicated advisor

- you can ask additional questions!

How much does it cost?

TAX RETURN

live calculator

online shipping

no codes and passwords

you don't need to have a DIGID

no advisor support

no verification

TAX ADVISOR SUPPORT

Additional service

verification by an advisor

verification of previous years

5-year guarantee

translations and appeals included in the price

contact with an advisor available at any time

advice regarding tax reliefs

We like when our clients are satisfied.

When you choose Belastigndienst, you focus on comfort and reliability. See why it is worth trusting professionals with your Dutch tax settlement. Below you can find reviews written by our Clients.

Everything went smoothly and quickly. If I didn't know something and wrote an email to support, literally after a short while I received a detailed message. I can honestly recommend the highest level of services!!!

Paweł KruszewskiProfessional service, they care about the customer, if you have a problem you can write an email and after a short while you will get a reply. The act quickly and efficiently without any problems. I settled my tax and zorgtoeslag.I received an insurance refund from the Netherlands.I received an amount that they calculated. I do not intend to switch to services of another company to. They are 100% trustworthy.HIGHLY RECOMMENDED!!!

Peter Zimonczyk2018 settled - the return came even in a slightly higher amount than it was calculated

AnetteThis app is great. It works quickly and efficiently. I am very pleased ????

Kate SkrzypczakI recommend the highest package - I was assisted by a kind staff member who checked everything and answered my questions about the extra refund.

Dominika Prusikreat application, helps you handle returns without much preparation. Without it, I would not be able to do it and now the money is already on my account 🙂

ChristopfI am very pleased with the application, everything was quick and efficient ????

Urszula KorniakI recommend them wholeheartedly. I received replies to difficult questions quickly. This made it possible for the entire process of submitting returns smooth.

MathewThank you ???? I thought that I would not be able to go through all the procedures related to the tax refund - thanks to your assistance I was able to get everything done quickly and without any problems. Dank u wel!

Pawel KotowiczEverything worked out efficiently. They are always on point and provide professional help

AsiaTax from the Netherlands - what are the payment deadlines in 2023?

Taxes in the Netherlands apply to anyone who has legally worked in this country. In order to be eligible for a tax refund, each payer must submit a return by 1 July for a given tax year. Currently, there are no specific payment deadlines in this country. Nevertheless a few rules have been adopted that are associated with meeting an indicated deadline or its failure to meet it. When will Dutch tax be paid out?

- Payers who submit their application to the Dutch tax office by the last day of March will receive a tax refund from the Netherlands by the last day of June of the same year at the latest.

- Payers who are late with supplying the application will wait for the refund longer. In this case, the tax office may process the tax return for six months up to even three years. Generally, the settlement takes less time as the the tax office usually pays the amount due within 3-4 months after submitting the application.

Tax settlement from the Netherlands - who does it apply to?

When working in the Netherlands, keep in mind that all income earned from working in this country is subject to different rules than in most other countries being members of the European Union. What does this mean? According to the law, expats who legally work in this country are required to submit a tax return and settle the tax with the Dutch tax office. Tax settlement from the Netherlands abroad applies to people whose income was obtained in the Netherlands at least in 90%. Such individuals are subject to favorable settlement rules and, additionally, they are entitled to various tax reliefs. A refund from the Netherlands is then fully profitable.

Dutch tax settlement - what documents do you need?

Anyone who is or was legally employed in the Netherlands can apply for a tax refund. The Netherlands is a country where you only need two types of documents - if you want to receive a refund of money for work, you will need:

- Jaaropgaaf tax card,

- a copy of personal ID or passport (with the original documents available for inspection).

Optionally, it is also worth having forms handy such as a certificate of income issued by the tax office, a copy of annual settlements or a payslip (salaris).

Jaaropgaaf tax card - what is it and how to obtain it?

Jaaropgaaf (also known as Jaaropgave) is a Dutch tax card that is provided to each employee by the employer. This is the basis for applying and obtaining a tax refund in the Netherlands. This form is a confirmation of your income and it is later processed by the tax office. It's important to note that each working person should receive the Jaaropgaaf after the end of the tax year, i.e. by the end of March.

Tax return from the Netherlands 2022,2021,2020,2019, i.e. settlement up to five years back

Do you need a tax refund for previous years of work? Contact us and let us deal with the problem. You can claim your due tax refund up to five years back. What does this mean? For instance, if you pay your taxes in 2023 you still have the option to file documents for 2022,2021,2020,2019, 2018 to the Dutch tax office so you have the chance to receive a tax return from the past years. You do not know how to settle Tax return from the Netherlands? Contact us and make an appointment with a professional.

What has an impact on the amount of the tax refund?

In addition to the resident status, the Dutch tax office takes into account several factors to calculate the tax overpayment, which affect the amount. They also include:

- tax year - Dutch tax thresholds are constantly changing, which has an impact on the amount of overpayment; it means that the higher the income, the greater the amount of the refund will be received by the payer,

- age - the income earned by elderly people is subject to lower tax thresholds, thanks to which seniors are entitled to additional reliefs,

- type of income - extra tax refund also depends on the source of income; an example may be people who were on a sickness benefit (medical costs, which were not covered by the insurance policy, result in a higher overpayment),

- fiscal partner - partnership settlement in the Netherlands is usually beneficial and results in a lower tax liability; fiscal partners are people who live together, are registered at one address, are spouses or have children together.